Knowing about c-number will prevent you from falling victim to fraudulent car dealers. See here all you need to know about online Customs number verification in Nigeria!

1. What is C number verification & why is it necessary?

Have you fallen victim to fake customs paper before? You probably know someone who went through hell just because he/she didn’t have the valid c-number on their Single Goods Declaration Form (SGDF). This is why it is very important you carry out Nigeria customs service c number verification before you buy that vehicle.

Verifying the authenticity of customs papers also insures you against Tokunbo stolen cars which have long pervaded the used car market.

Well, in case you didn’t know, the c-number is utilized in registering the vehicle’s details and duty payment into the database of the Customs service. On the form, we have information such as the agency in charge of the job (consignee info), entry means (vehicles’ road via land borders and seaports), office of entry (customs command at Idiroko or Tincan port or Seme customs command), vehicle’s location and discharge location (Idiroko border/Seme border/Tincan), name/address of the person(s) responsible for finances (vehicle’s owner) and so on.

To avoid getting into a customs duty paper scam, you need to contact an authorized auto dealer close to your location

Have you heard of ‘Machined outside’ or ‘MO’? This is a commonly adopted process by scammers, who forge receipts from the bank and all customs documentation. It takes some level of expertise at this stage to decipher fake from genuine. It might look real to you, but not in any way registered in the database of the Customs Service. This is very prevalent at borders and ports since fraudulent Customs officials connive in smuggling vehicles out of the borders and ports.

Notes: Do not fall victim to fraudulent activities! There is currently a ban placed on land borders, which stops the importation of vehicles and also the running of duty papers in Lagos.

2. Ways to do Nigeria customs duty verification

By introducing NCS public helpdesk numbers, you can verify your custom duty without going to their office. You can refer to the helpdesk contact we provided below for verification. When you make the call, you hold on for a response and are asked to provide necessary information:

- Custom Reference number or C-number

- Year of payment

- Custom post where you made the payment

While providing the information, the Custom officer is already putting it into their database to verify this information in just 5 minutes, you will know the authenticity of the custom duty papers you provided.

All the above information can be found on your SGD form (single goods declaration form), which is given when buying foreign cars at any dealership. Two cars cannot have the same C-number. Every car being imported into Nigeria, whether new or used, must go through customs and obtain custom declaration or customs papers.

There is the c-number boldly written at the top right corner of the document. There is no way your eyes can skip this number. There is also the date right under the number. This sole purpose of the date reflects the payment date for the duty, done at the bank and when recorded into the customs’ ASSYCUDA (automated system custom data) database. When the payment is reflected on the database, it shows the document with you is genuine and vice versa.

The penalty for moving around with fake documents is either seizure or confiscation, especially when you are stopped at a checkpoint while embarking on a long trip. If you want to buy a car from a car dealer, you should do c number verification to know if they are genuine because there are a lot of fraudulent auto dealers out there who will end up giving you fake papers they made after smuggling the vehicle into the country.

3. How to check custom duty online in Nigeria

If you are wondering if you can check the custom duty online by yourself, the answer is NO! The online platform for checking custom duty is not yet available in Nigeria. However, to combat this issue, the Customs service has provided a new method whereby you can check duty through the following helplines:

- 094621598

- 094621599

- 094621507

Most importantly, you will need your SGD form with a c-number to carry out this process. Without it, it is not possible. You can either send a text message or make a direct phone call to any of these numbers for your online custom-duty paper verification in Nigeria.

To check the validity of the custom paper, there are certain steps you have to follow. Below are the examples and guidelines to check custom duty in Nigeria at 3 entry points, including Lagos port, Seme, and Idiroko.

Illustration #1: This is a real image of the 2007 Audi Q7”s SGD form. You might encounter difficulty accessing the full document since the owner’s identity has been concealed for confidentiality and security reasons. Make sure you have a similar document before you contact those helpdesk numbers.

SGD form designated for the foreign used 2007 Audi Q7

Illustration #2: The displayed picture shows a used 2007 Audi Q7, which is still in Cotonou, Benin Republic. The Tokunbo vehicle is yet to enter Nigeria but has been fitted with a temporary 16hr number plate, set to enter the country of destination soon. It wouldn’t be allowed to do so without a genuine custom document.

2007 Audi Q7 set to be taken to Nigeria from Cotonou

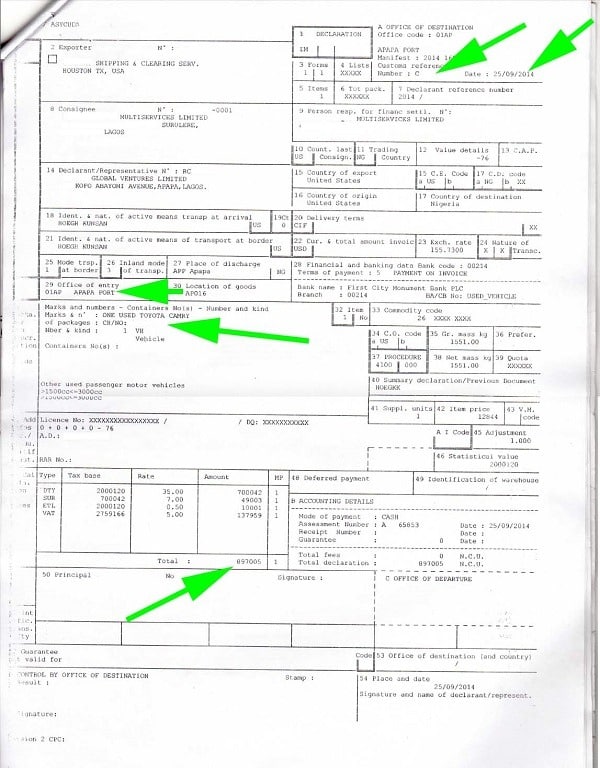

Illustration #3: The third image is an example of the SGD form, what it looks like and what you should focus on when running a check on it. Areas where the green arrows are pointing, are where you need to put your utmost attention to avoid getting a fake paper.

The most vital information on the SGD form has been earmarked with directional green arrows

When you call the numbers provided above for your custom paper verification, they will ask you to provide information such as:

- c-number or customs reference numbers

- last six digits of the vehicle chassis number, model,

- year of duty payment

- Nigerian Customs Command, where you paid the duty

The information provided will be then entered into the system by the agent at the other end of the call to help you verify if they truly have it on their system. You should be able to clear your doubt in the space of 5 minutes whether you have been moving around with fake custom paper or not.

When you are sure that the paper is genuine, you can proceed to buy the vehicle from the dealer. This simple process prevents you from buying a car from fraudulent auto dealers, who might have smuggled those vehicles in with fake papers. Verification of the custom paper is another big step to avoid buying a stolen vehicle or undue seizure of your car at the point of checking.

How much does it cost to check custom papers online?

The helpdesk service is provided by Nigeria Customs to assist residents in verifying the genuineness of custom papers. It is meant to be free for all, but you should expect a phone charge when calling someone.

In case you don’t want to spend time finding all types of information and can afford a certain amount of money for this, you can contact some online agencies that do c-number verification services. Usually, to have your paper checked via these agents, you would have to pay a sum of 3,000 naira for a single check and 4,500 naira for a printout. If you are attempting to recover lost custom papers, you will be asked to pay a sum of 25,000 naira though fees may vary at different places and times as well.

4. How to check Nigeria’s custom tariffs to calculate duty tax payment

This part might not be directly related to c number verification but you should know for your own sake. Being aware of tariffs helps you to judge whether the amount you pay for the car dealer is reasonable or not.

Checking Nigeria custom tariffs is pretty simple. All you have to do is go through this link: https://trade.gov.ng/tariff/search.do where you will be asked to pick between online consulting or downloading the printable format.

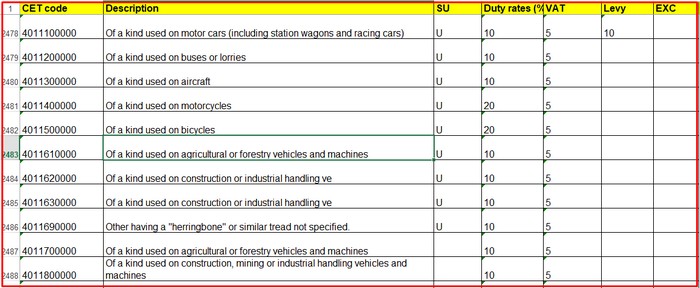

All your queries and general rules will be attended to on the website. It will be required of you to Download full tariffs in excel format, which will give you comprehensive information of all custom tariffs.

You can also go through this link to access the tariff list online. After you have accessed the website, locate the left side where you will see Quick Search CET Tariff Panel. You should be able to see the tariff that suits your interest.

The tariff list shows Nigerian duty rates and taxes for groups of imported goods

5. FAQs about Nigeria’s custom duty verification

- How can I identify fake custom papers?

You can identify a fake custom paper by checking and verifying its c-number or custom number. This can either be done by verifying through helpdesk contacts or visiting their office.

- What is the Nigeria custom duty on used cars in 2019?

To clear a used car in Nigeria, it depends on the capacity, size and manufacture date. Used vehicles are expected to pay 35% duty while more recent cars will be expected to fall within 35% levy charge.

- What do I do if I lose my custom paper?

For lost custom papers, you will be required to pay a recovery fee before you can request for new one. You can always contact the helpdesk numbers to be guided the procedure to recover your lost papers.

It is advisable you keep it carefully to avoid such situations.

- How to calculate customs duty on a car

To calculate the customs duty of a car in Nigeria, it makes use of the system that requires a 35% duty and a 35% levy tax on the vehicle’s cost. This is a total of 70% of every imported used vehicle to the country. After combining the vehicle price, duty, and levy tax, you also need to pay 5% of that total for VAT as well.

All the cost is calculated after your car value is converted to Nigerian naira, using the NCS exchange rate (₦326/ $ from June 2019).

You are just one call away from verifying the authenticity of the customs duty paper with you

6. Final notes

I hope you guys are satisfied with our C number verification steps as well as other guidelines related to the process.

Though the procedure seems easy, you might encounter some problems in getting your SGD form or locating the necessary information on it. Don’t hesitate to ask for support from NCS helpdesk staff because they are the ones to understand the most thoroughly about the stuff.

Also, if you have more information to add or want to correct any in this post, please leave your comments below so we can check. Thank you!